Required Notices

Benefited New Hire Information

Welcome to the City of Orem! We are excited to have you join our team. To the right you will see a list of nine categories all containing information regarding benefits and policies here at the City of Orem. Please click on the blue heading of each category to view the documents in that category. You will need to review all the documents in ALL the categories!

Once you have reviewed all the information you will need to complete the forms and online enrollment discussed in categories 7, 8 and 9. Below are the directions for those categories:

#7. New Hire Paperwork – Complete the new hire forms by selecting which type of employee you are (general employee, police officer or firefighter). You will be required to bring your form(s) of ID into the HR office (Room #103) to verify your eligibility to work in the United States. Copies of your ID will not work. If you fail to complete the new hire paperwork and bring your ID into HR within three days of your date of hire, your employment will be terminated. This is per federal law. If you are currently employed by the City of Orem as a non-benefited flex employee and are moving to a full-time position, select which type of employee you are (general employee, police officer, or firefighter) in the “Moving from Flex to Benefited” in section #7.

#8. Retirement Enrollment Forms – Instructions for completely the retirement enrollment forms can be found in the section below. Please read the instructions thoroughly and follow them exactly. You will need to complete the ICMA-RC 401K enrollment form and after you decide which company you want to have your 457 with you will do their enrollment form. You will need social security numbers and dates of birth for everyone you will want to list as a beneficiary.

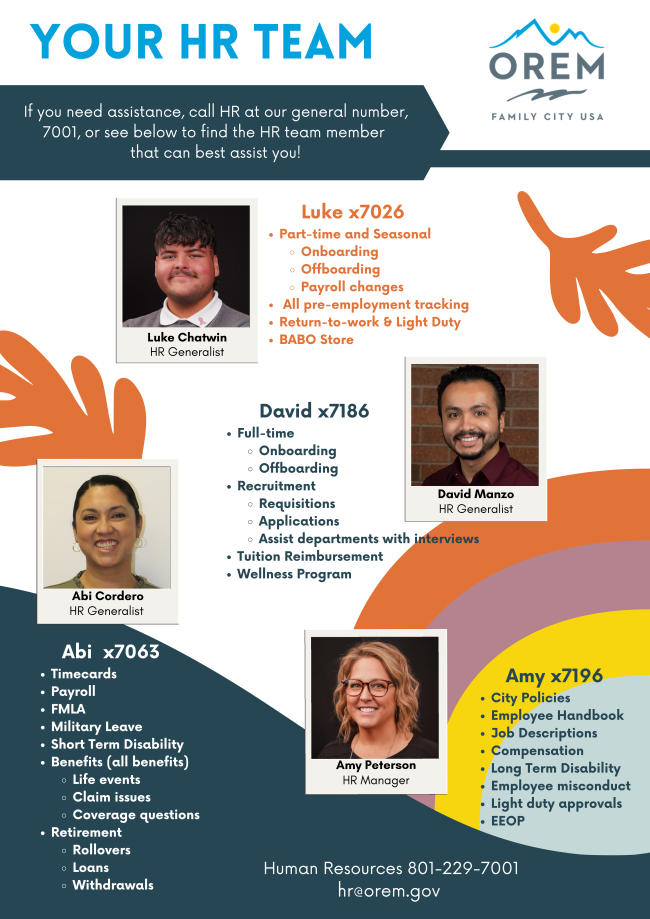

If you have questions please contact HR.

1. Introduction and Policies & Procedures

a. Probation Period and Performance Evaluations

b. Parking Policy

c. Employee Declaration

d. Employees Work Ethics and Disclosure Policy

e. Workers Compensation

f. Charitable Campaign Procedures

2. Medical, HSA, Dental, Vision, FSA & Voluntary Benefits

a. Benefits Explanation Video (Video is from our 2023 Open Enrollment and goes over all benefits in detail)

3. Retirement

a. Utah Retirement Systems & ICMA-RC 401K Summary Chart

b. ICMA-RC 401K Enrollment Booklet

c. Tier 2 URS Pension Information

d. 457 Deferred Compensation Plans (Social Security Replacement)

e. ICMA-RC 457 Enrollment Booklet

f. Windfall Elimination Provision

g. Retirement Health Savings Plan

4. Miscellaneous Benefits and Programs

5. Required Notices

a. Children’s Health Insurance Program (CHIP)

b. Utah Protection of Public Employees Act

c. New Health Insurance Marketplace Coverage Options and Your Health Coverage

d. Orem City Legal Notices Packet

e. PEHP Legal Notices

i. Summary of Benefits and Coverage (SBC) HDHP

ii. Summary of Benefits and Coverage (SBC) Traditional Plan

iii. SBC Glossary

iv. Creditable Coverage Employer Notice

v. PEHP Notices

6. Required Material for Your Review

b. Watch the harassment training video by clicking this link: https://youtu.be/tVtJcVbbjcA

7. Complete the appropriate “New Hire Paperwork”

New Benefited Employees

a. Benefited New Hire Forms – General Employees

b. Benefited New Hire Forms – Police Officer

c. Benefited New Hire Forms – Firefighter

Moving from Flex to Benefited

a. Flex to Benefited – General Employees

8. Complete Retirement Enrollment Forms

a. Review the information in Step 3 above.

b. Follow the instructions and complete the appropriate retirement enrollment forms in the section below.

9. Complete Online Benefit Enrollment by clicking here.

a. This online enrollment will enroll you in all benefits discussed in Step 2. Detailed instructions were emailed to you.

Retirement Enrollment Forms

It is very important that you read ALL the instructions below and do exactly as they state. The retirement enrollment forms to the right can NOT be completed and signed electronically. You will need to print these forms, complete them and return them to HR. You can bring them to the HR office, email them to ampeterson@orem.org or fax them to 801-229-7306.

Since you are 100% vested upon hire with both the 401K and the 457 you must indicate on the enrollment forms how you want the money sent to the accounts to be invested. MissionSquare (formerly ICMA-RC) has a separate investment sheet which contains the fund code numbers you will need to complete the MissionSquare 401K and 457 enrollment forms. The enrollment forms still show ICMA-RC as the company name. They have not provided new forms with their new name yet.

MissionSquare (formerly ICMA-RC) 401K – If you would like money deducted out of your paycheck for the ICMA-RC 401K you will check the “Elective pre-tax deferrals” box in section 2. You MUST put a percentage NOT a dollar amount.

MissionSquare (formerly ICMA-RC) 457 – You will need to indicate how much money you would like deducted from your paycheck. Check the “Pre-tax contributions” box in section 2. You MUST put a percentage NOT a dollar amount you want deducted out of your paycheck. Remember the city will match 4% of what you contribute to the 457!

If you have questions please contact HR.

Health Benefits

-

- Employee Assistance Program (EAP) – Assistance with life’s challenges. Free of charge. You can also call 800-490-1585.

-

- Select Health – All your healthcare needs in one place

-

- MetLife Dental – Check claim status, view benefits, etc.

-

- Employee Benefits Booklet – The most current information on employee health benefits

- 2025 Open Enrollment Webinar

-

- Employee Navigator – Benefit enrollment and documents

-

- Health Equity – Managing your health savings account online

- Life Insurance & Accidental Death/Dismemberment – Information on the city’s available life insurance policies